TRX Price Prediction: Bullish Momentum Builds as Regulatory and Technical Factors Align

#TRX

- TRX shows bullish technical signals trading above its 20-day MA with MACD convergence

- Regulatory developments create positive sentiment for cryptocurrency adoption

- Network activity and profit-taking suggest both interest and potential volatility

TRX Price Prediction

TRX Technical Analysis: Bullish Signals Emerging

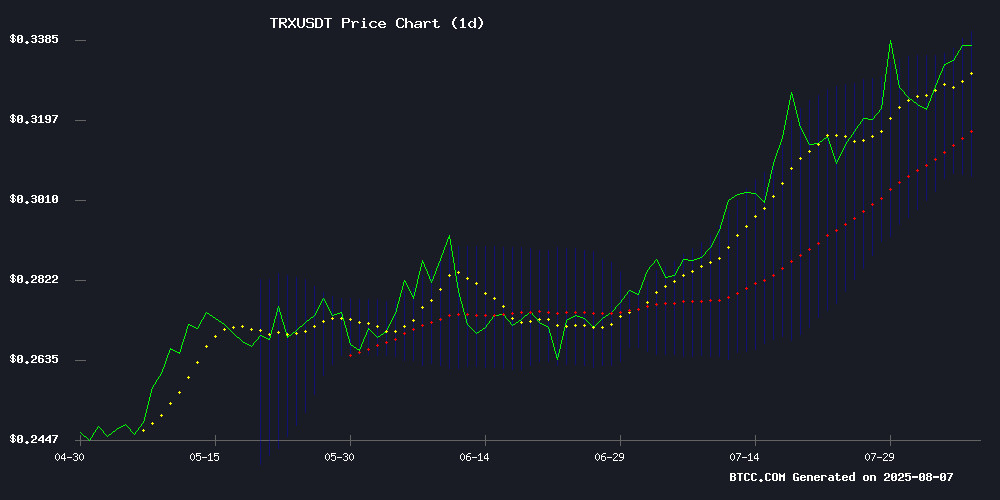

According to BTCC financial analyst Olivia, TRX is currently trading at $0.3412, above its 20-day moving average of $0.32369, indicating a bullish trend. The MACD shows a slight convergence with the histogram at -0.000538, suggesting weakening downward momentum. The price is NEAR the upper Bollinger Band at $0.341453, which could signal overbought conditions but also strong upward momentum. Olivia notes that if TRX maintains above the middle band ($0.32369), it may test the $0.37 resistance level soon.

TRX Market Sentiment Boosted by Regulatory Tailwinds

BTCC financial analyst Olivia highlights that TRX is benefiting from positive news flow, including Trump's executive order allowing cryptocurrencies in 401(k) plans. This regulatory development, combined with TRON's network activity and $1.4 billion profit-taking spree, creates a bullish environment. Olivia points out that the $0.37 target mentioned in news aligns with technical analysis, but warns investors to monitor potential volatility from large sellers identified by Glassnode.

Factors Influencing TRX's Price

Trump to Sign Order Opening 401(k)s to Crypto, Real Estate, and Private Equity – What It Means for You

President Donald TRUMP is set to sign an executive order that could revolutionize retirement investing by allowing 401(k) plans to include cryptocurrencies, real estate, and private equity. The directive mandates a review of current regulations by the Labor Department and SEC, signaling a potential watershed moment for alternative assets in mainstream finance.

The order specifically targets ERISA-governed retirement plans, instructing regulators to reassess fiduciary rules for administrators offering exposure to these non-traditional investments. This MOVE aligns with the administration's broader push to integrate digital assets into U.S. economic policy frameworks.

Federal agencies will coordinate to identify necessary regulatory changes, with the SEC tasked specifically with easing access to alternative investment options. The implications for retail investors could be profound—potentially unlocking trillions in retirement capital for the crypto markets.

TRON's TRX Eyes $0.37 as Network Activity and Bullish Momentum Build

TRON's native token TRX demonstrates strengthening bullish momentum, fueled by rising spot demand and robust network activity. The asset has climbed from $0.26 in mid-June to $0.3393, now testing a critical resistance zone between $0.344 and $0.351. A breakout could propel prices toward the $0.371 Fibonacci extension target.

Network metrics reveal deepening adoption, with TRON processing over 8.29 million USDT transactions last week. Mid-sized transactions ($101-$1,000) dominated at 39% of activity, signaling growing utility in remittances and crypto commerce. Meanwhile, microtransactions below $10 dwindled to 5.63%, suggesting ecosystem maturation beyond simple low-fee transfers.

The parabolic rise faces a decisive test at current levels. Either a breakout confirms the bullish structure, or rejection could trigger a retest of the ascending trendline. Market participants watch whether TRX can convert its fundamental strength into technical upside.

Trump Executive Order Paves Way for Cryptocurrency in 401(k) Retirement Accounts

President Donald Trump is set to sign an executive order that could revolutionize retirement investing by allowing alternative assets—including cryptocurrencies—into 401(k) plans. The directive tasks the SEC with revising regulations to accommodate private equity, real estate, and digital assets in defined-contribution plans, a move that WOULD unlock a $12 trillion market for asset managers like Blackstone and KKR.

Critics warn of heightened risk exposure for retirement savers, but the order signals growing institutional acceptance of crypto. The Labor Department will collaborate with Treasury and financial regulators to explore parallel rule changes, potentially accelerating mainstream adoption of Bitcoin and other digital assets.

10 Best Binance Alternatives in 2025

Binance, the world's leading crypto exchange with $128 trillion in lifetime volume and 280 million users, faces growing competition as traders seek alternatives. Regulatory pressures and demand for specialized features drive migration to platforms like Coinbase for beginners, Bybit for derivatives, and OKX for low fees.

Market fragmentation accelerates as exchanges carve distinct niches: Kraken dominates advanced trading tools, Bitget leads copy trading, while MEXC captures speculative demand with new token launches. Liquidity dispersion across these venues reflects maturing infrastructure beyond the Binance hegemony.

Tron Network Sees $1.4 Billion Profit-Taking Spree, Glassnode Identifies Key Sellers

Tron (TRX) investors have cashed in $1.4 billion in profits over the past 24 hours, marking the network's second-largest profit-taking event of 2025. On-chain analytics firm Glassnode traced the sell-off to a specific cohort of TRX holders, though the exact demographic remains undisclosed.

The realized profit metric, which tracks gains locked in by selling coins at higher prices than their acquisition cost, spiked dramatically. Notably, realized losses remained negligible, suggesting disciplined profit-taking rather than panic selling. This mirrors a broader trend of strategic capital rotation across crypto markets.

TRX's on-chain activity shows sophisticated investors are rebalancing portfolios after the asset's recent rally. The profit-taking wave comes as altcoins face increased volatility amid shifting liquidity conditions across major exchanges including Binance and Bybit.

Trump's Executive Order May Protect Crypto from Bank Discrimination

US President Donald Trump is preparing an executive order that could shield cryptocurrency firms from alleged banking discrimination. The order, expected within days, would direct regulators to investigate potential violations of fair lending laws by banks that cut off services based on political views or involvement in crypto.

The move comes amid longstanding industry complaints about 'Operation Chokepoint 2.0' - a perceived Biden-era initiative that saw accounts abruptly closed without explanation. High-profile cases include Coinbase CEO Brian Armstrong's 2023 revelation about JPMorgan Chase's crypto account threats, and Elon Musk's 2024 claim of 30 tech entrepreneurs losing banking access.

Banks maintain their actions comply with anti-money laundering regulations and represent prudent risk management. However, the Trump administration appears poised to challenge the 'reputational risk' justification often cited for denying services to crypto-related businesses.

Is TRX a good investment?

Based on current technical and fundamental factors, BTCC analyst Olivia suggests TRX presents an interesting opportunity. Here's a summary of key considerations:

| Factor | Assessment |

|---|---|

| Price Position | Above 20-day MA ($0.32369) |

| MACD | Showing convergence (-0.000538) |

| Bollinger Bands | Near upper band ($0.341453) |

| Regulatory News | Positive (401(k) inclusion) |

| Network Activity | High ($1.4B profit-taking) |

While the $0.37 target appears achievable, investors should be aware of potential volatility from profit-taking and monitor key support at $0.32369.